> You can choose to pay the balance due to the IRS using EFW, Check or Money Order. > Enter the estimate of total income tax payment and balance due, if any. > Enter your Personal Details such as Name, SSN, and Address.

> Select the extension type you would like to file.

2016 tax extension 4868 download#

> Simply download our app, and log in to your ExpressExtension account. Get started with ExpressExtension, an IRS-authorized e-file provider for IRS tax extension forms, and e-file your Form 4868 for an automatic extension of time to file your personal income tax return.ĮxpressExtension provides a user-friendly, step-by-step filing process that helps you to file tax extension Form 4868 in minutes with the convenience of our mobile app. However, if form 4868 gets rejected for any other reason, users have the option to correct and resubmit at no additional cost.

2016 tax extension 4868 full#

In addition, ExpressExtension offers an Express Guarantee this tax season, meaning any user who files a Form 4868 and receives an IRS rejection stating duplicate filing will get a full refund.

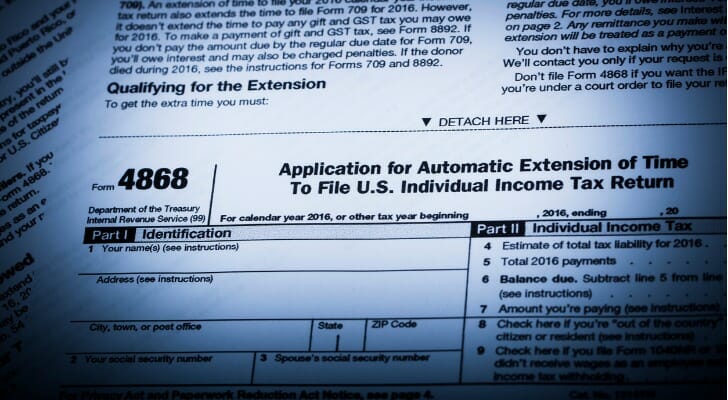

The IRS suggests that individuals e-file their extension Form 4868 both for faster processing and the ability to get instant approval. Form 4868 provides an automatic 6-month extension of time to file the 1040 income tax return with the IRS. Individuals that need more time to file their income tax returns can apply for an extension using Form 4868. individuals must file their income tax return 1040 with the IRS this year by May 15.

2016 tax extension 4868 zip#

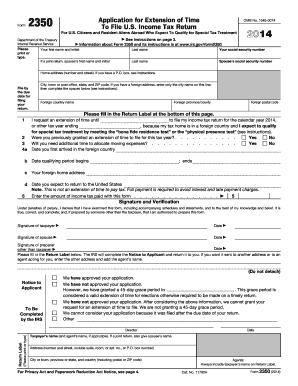

The form 4868 has two parts in its presentation asking for individual identification details in the first part viz., Name, Address, City, town or post office, State, Zip code. That’s why the initial briefing notes are given above. They can use form 4868 in case they want to extend up to 6 months and so that they can file the income tax returns on or before October 15 th, 2014In the second case, by the request through form 4868, the automatic extension of time say 6 months is allowed but one needs to pay the tax due on or before April 18 th, 2017 and file returns in a calendar year on or before October 16 th,2017.Īpplication for automatic extension of time to file US individual income tax return is form 4868 which is simple in its form but complex to understand.

But should pay tax dues on time the April 18 th and file returns in a calendar year on or before June 16 t, 2017.

In the first case say 2 extra months extension is allowed automatically (notwithstanding form 4868) for those on the due date April 18 th, 2017 who are out of the country and U.S.citizens or residents who live outside USA and Puerto Rico or elsewhere even without extension request. The Title is clear to mean that it’s about payment of tax dues on time on or before 18 th April 2017 and e-filing form 4868 is to get convenience of extension of timefor normal Income tax return filing as per the applicable and allowable IRS law (form 4868) say first 2 months from April 18 th or 6 months from April 18th, 2017.

0 kommentar(er)

0 kommentar(er)